Term Life Insurance Q&A

About BeyondQuotes

- Why should I choose BeyondQuotes?

- Which companies do we represent?

- Is BeyondQuotes licensed where I live?

- Is my information confidential?

- Do you only offer rate quotes?

- How do we choose which companies to represent?

Defining Coverage

- How much Term Life Insurance do I need?

- What are "level" policies?

- What should be the term length?

- Is it worth insuring my spouse on my policy?

- Can you explain the difference between Term and Whole Life plans?

- I suffer form a pre-existing condition. Can I still be insured?

Applying for a Policy

- How do I apply for Term Life Insurance?

- How do I find the best value plan for my needs?

- What is the waiting period between applying and coverage?

Shopping for Term Life Insurance with Clark Howard

It is quite distressing to see how some people with small kids have life coverage. The situation is the coverage that is best for individuals with dependents is not promoted by the industry as a necessary rule. Spouses who do not work and take care of home full time too have equal need of life coverage as a working person. Term life insurance Clark Howard addresses this issue…

As per a new survey it has been found that the average expenditure of parents who have to deal with utilities and living costs. is more than $40,000. More than anything else it grabs one’s attention as in reality it is not what is earned by parents who are staying at home, suggesting a high incidence of household debt.

In case the stay at home spouse meets an untimely death, the burden will immediately pass on to the remaining parent to look after the kids and also all the daily activities looked after by the stay-at-home parent. This is why it is essential to have term life insurance for parent who stays at home as per Clark Howard.

Level Term Life Insurance is the key as per Clark Howard

So often, people are provided coverage that are really costly and have high commissions attached to it. That is a failure formula as one has to pay regular premiums every month, and when there is a lapse in coverage it is just too much for a person.

As per a research done by Smart Money, nearly a quarter of the entire insured people stop paying for the plan in the first 3 years of the plan. As an insurance plan reaches the ten year mark, approximately half of the people quit paying for coverage. So all that money that was paid in the past years almost round of to zero, as once a policy is lapsed it does not provide the same amount of benefits as when it is current and running.

Purchasing Term Life Insurance Clark Howard Style

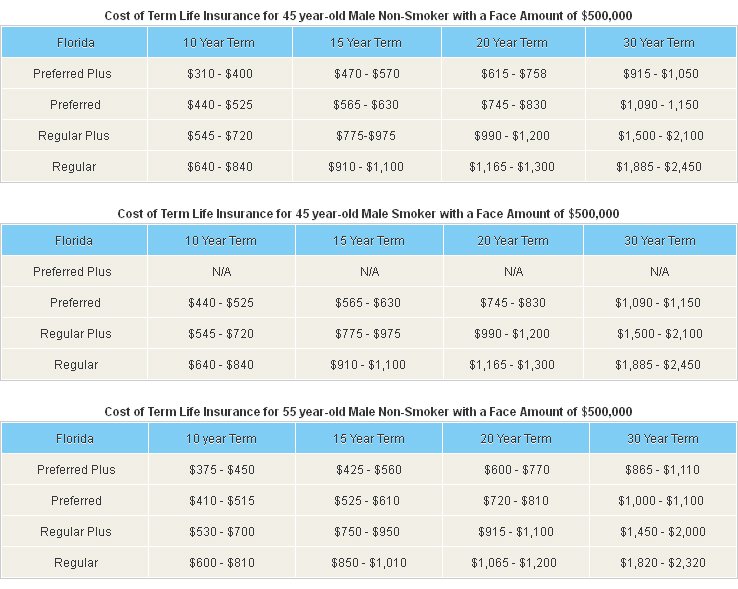

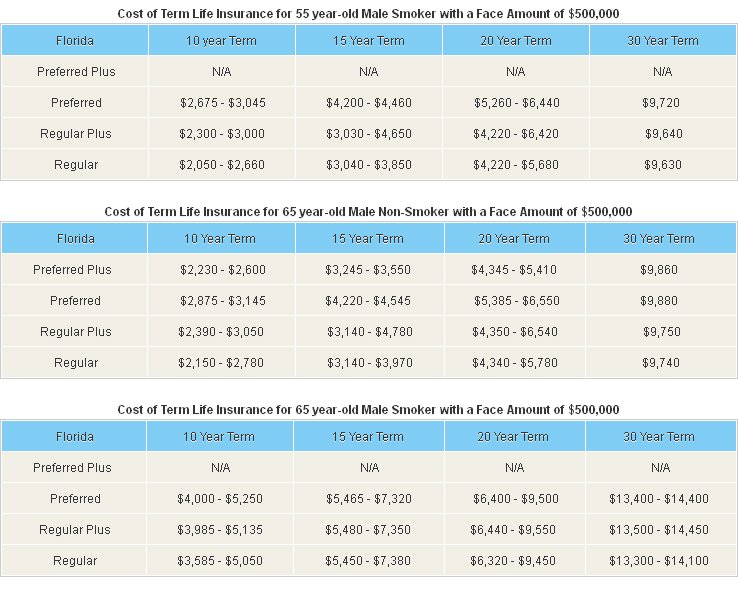

Purchasing level term insurance costs almost nothing at all and is quite simple. As per a report from Smart Money, a 45 year old person can get coverage of $500,000 for duration of twenty years and has to pay just $50 every month.

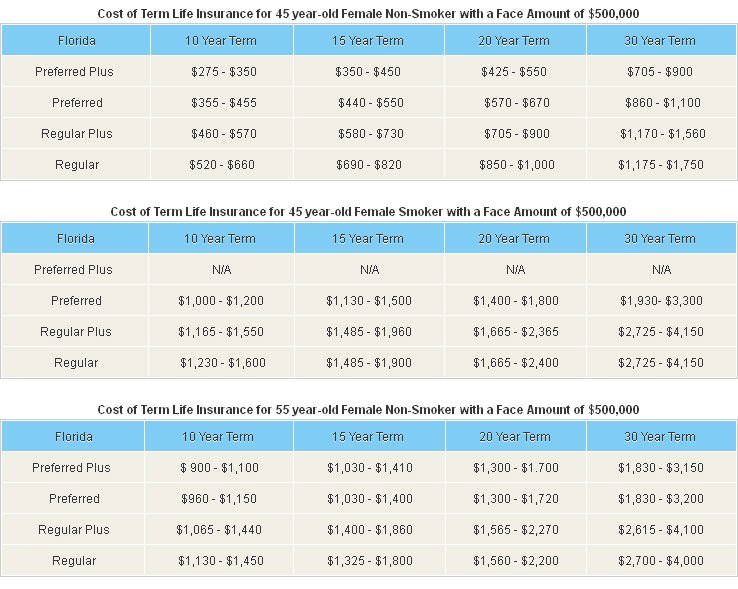

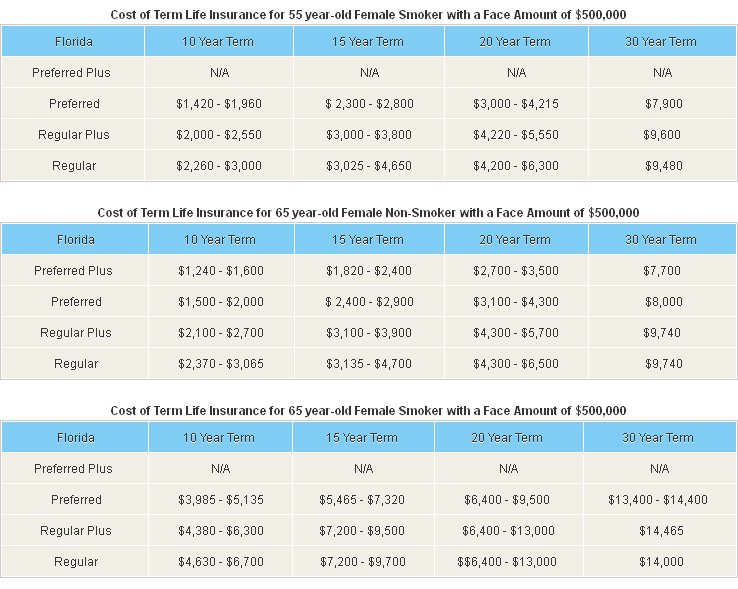

Since women have longer life expectancy and they tend to take more care of their health, so term life insurance Clark Howard is more economical for them. In case the spouse who stays at home is a woman, it is better to purchase term life insurance for fifteen or twenty years, depending at which age the kids will become independent.

Things to remember when purchasing for Term Life Insurance Clark Howard

People can shop for term coverage by sitting at the comfort of their homes by using internet. One can compare quotes from different companies on various websites, one such is ours, and it is quotes from various reputed companies that have high credit rating. People who do not access to internet than also it is fine.

One can have fair amount of idea of the rates at which insurance coverage is available through money magazines that are available in the market. Numerous companies place their advertisements in there, along with the rates.

Term life insurance Clark Howard may become expensive in cases where the applicant is suffering from a health condition; in certain cases the provider may even deny the coverage. People who are facing this issue, are known as ‘rated’ in the insurance industry, which means the applicant has to shell out more money in order get the coverage. Here are some things to bear in mind as one is searching for coverage:

- The simple answer to the amount of coverage a person should have is approximately ten times of his or her annual income.

- People who have health issues should purchase life coverage at their work. But in case you want to purchase coverage on your own, it is better to go through medical examination and clear it, so that you enroll in at a lower premium and have fewer adjustments to make in the monthly budget. In many cases, people do not stay with a single company forever, so when they leave their company they also have to leave their term life insurance Clark Howard.

Spouse who stay at home are in equal need for an insurance coverage. The loss of house wife also has drastic consequences, particularly in cases where there are dependent children. It becomes really difficult for the working spouse to take care of the house hold daily activities.

ht-800-120-10232012